There has been a series of conflicting news in recent weeks. NPD recently announced tablets will outsell notebooks 6 to 1 by 2016. On their current trajectory, tablets will likely outsell desktop PCs this year on a worldwide basis and edge out notebooks by 2014. At the same time, Blackberry’s CEO recently suggested Tablets won’t even exist by then. “In five years I don’t think there’ll be a reason to have a tablet anymore,” Thorsten Heins said in an interview a few weeks ago at the Milken Institute conference in Los Angeles. “Maybe a big screen in your workspace, but not a tablet as such. Tablets themselves are not a good business model.”

While the Innovator’s Dilemma might suggest companies will dismiss the potential of categories in which they have no real market power, I’m not sure I would be as bold as to predict the entire demise of one of the few real growth segments within the consumer tech space over the last three years. At the same time, netbooks provide a recent and viable example of a category which experienced tremendous growth – seemingly out of nowhere – and then disappeared nearly as quickly.

There are two key questions when looking at the future of a given technology – how many units are sold and how does the technology evolve. Let’s start with the former question first.

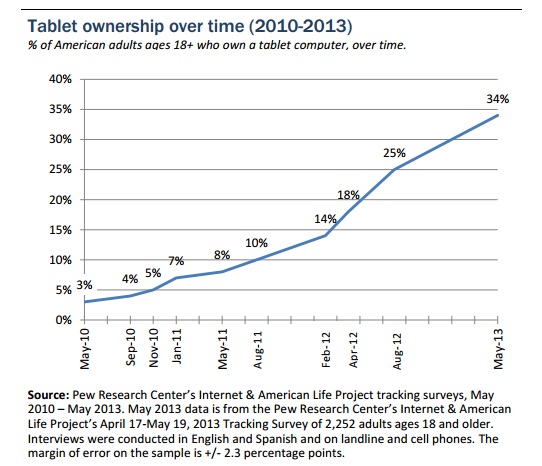

We are at an interesting inflection point for tablets. If you consider April 2010 as the beginning of the modern tablet era, ownership rates have accelerated extremely fast. Pew’s report a few weeks ago (Tablet Ownership 2013) is largely consistent with recent CEA research on tablets. Today about a third of US Adults own a tablet. The highest rates of of tablet ownership are among adults in their late thirties and early forties – with nearly half of adults between 35-44 owning a tablet (statistically more than any other age cohort).

Pew also found about half of those with a college degree own a tablet – also statistically higher than any other education cohort. Finally, half of parents with minor children living at home own a tablet computer compared with just 27% of nonparents owning a tablet. Over the last 12 months many of these population segments have experienced significant jumps in ownership rates. For parents with minor children living at home, tablet ownership has risen from 26% in in April 2012 to 50% in May 2013. Tablet ownership among college graduates rose from 28% to 49% over the same period.

Pew also found about half of those with a college degree own a tablet – also statistically higher than any other education cohort. Finally, half of parents with minor children living at home own a tablet computer compared with just 27% of nonparents owning a tablet. Over the last 12 months many of these population segments have experienced significant jumps in ownership rates. For parents with minor children living at home, tablet ownership has risen from 26% in in April 2012 to 50% in May 2013. Tablet ownership among college graduates rose from 28% to 49% over the same period.

According to data from CEA’s recently published 15th Annual CE Ownership and Market Potential, tablets are the largest addressable market. Twenty-eight percent of non-owning households say they will own a tablet within the next 24 months – representing some 20 million households. No other category has comparably sized addressable market.

CEA research shows that about three-fourths of consumers in the U.S. say they’ll own a tablet. We might roughly assume 75%-80% of these individuals actually follow through with these stated intentions. That suggests somewhere between 55% and 60% of individuals will own a tablet.

At the same time broad adoption is growing, we also see density increasing. Density is the number of a given device owned by owning households. Two years ago, about 11 percent of households owned a tablet and on average they owned 1.2. At the start of last year about 22 percent of households owned a tablet and they owned 1.4 on average. This year, tablet-owning households own an average of 1.5 tablets. Adoption and increasing density create a compounding effect that have had sales more than double last year and are expected to combine to grow tablets by another 45 percent in 2013.

How high can density go? TVs have been the most successful technology product (and perhaps the most successful product of any kind). Not only do most US households own a TV, they own an average of 2.9 TVs per household. TVs have the highest adoption rates and highest density rates. For comparison, the next closest product category is smartphones which has jumped in the last 12 months to 2.2. Notebook computers are at about 1.7 per owning household. Neither enjoy the broad adoption rates of TV.

TVs tend to be more utility devices that are assigned to room as opposed to individuals. Smartphones and tablets tend to be more personal devices and therefore assigned to individuals instead of devices. The average US household today has about 2.55 people in it. At 2.2 smartphones per owning household, smartphones probably won’t experience significant growth through an increase in density. Tablets will likely approach – but no surpass – density rates in the 2.2 per household range. Usage scenarios could change such that tablets are eventually left in rooms like the kitchen, living room, or bedroom in addition to individuals having a personal one. Should that scenario develop then certainty we could see density rates begin to approach TV-like rates of 2.9 per household.

An important factor in thinking about the future of tablets is the rate of replacement for tablets. CEA research shows the average age of tablets in use continues to increase. Today it stands at about 2.1 years. I expect this will continue to top out at the three year rate or so. In other words, the average tablet in use will be about three years old – suggesting tablets are replaced on a roughly three-year cycle.

Given the above assumptions, we probably see tablet adoption peak in the 55% to 60% range – with the potential of growing as high as 70% to 75%. We probably see 2.2 to 2.5 per household and we see consumers replace tablets roughly every three years. These assumptions suggest 65 to 70 million households own tablets – with the potential of up to 90 million households eventually owning the technology. With an average of 2.2 million per household and a replacement of roughly 3 years we are looking at annual unit volume in a steady-state environment in the 48 to 52 million range. If 75 percent of households eventually own tablets then this range could grow to 65 million. Similarly, if tablets are owned at a rate of close to 2.5 per household then we are looking at annual volume in the 55 to 60 million range with the potential to grow to 75 million.

The above calculation is looking at the steady-state environment so the key question becomes – how quickly do we reach this environment. I’ll save that for another post. Let’s now take a look at how usage could be changing.

We probably haven’t reached the potential impact tablets can/will have in a number of different areas. With E3 taking place a few weeks ago, we heard a lot of news about the new game consoles from Sony (the PS4) and the Microsoft (the XBox One). We are also seeing how new games for these consoles will add tablet-enabled capabilities.

I won’t spill much digital ink on prices, but I did hit on some of this in my post covering Apple’s financial results. Today we saw the introduction of the new Nexus 7. A recent article in the Financial Times suggests traditional PC OEMs are entering into the tablet market to keep their brands relevant. Their entry will subsequently drive down prices and might also impact operating margins of the OEMs. All of this could influence the rate at which owning households own the device or the rate at which consumers replace tablets.

Samsung recently announced the ATIV Q – a hybrid tablet that will run both Android and Windows. It will be interesting to see if this approach becomes the future.

Somewhat related, I often wonder if tablets are just a hybrid technology unknowingly helping us transition from personal computing as we’ve experienced it through PCs to the next age of more ubiquitous computing. The face of computing is changing with the introduction of computing platforms like the Raspberry Pi.

Table usage scenarios will be driven by two key product attributes – feature set and software development. As Ben Bajarin recently wrote– battery life is the new MHZ race. This is certainly true for the wearables computing segment and mobile computing categories like smartphones, but I think it might also impact how we use tablets moving forward.

Future tablets will have greater array of sensor than we currently see today. Tablets launched with touch screens, accelerators and a few other sensors, but we haven’t seen an great extension since the initial launch of the category three years ago. I expect that to change moving forward.