With the April jobs report out last Friday there are a number of characteristics of the current labor market worth noting. Most of the headlines last week focused on strong than expected employment gains and a decline in the unemployment rate that takes it down to 4.4 percent – the lowest since May 2007. The unemployment rate was also that low in March 2007, December 2006, and October 2006. The lowest the unemployment rate ever got during the last expansionary period (November 2011 through December 2007) was 4.4%. To find a lower unemployment rate one has to go back to the 1999-2000 period.

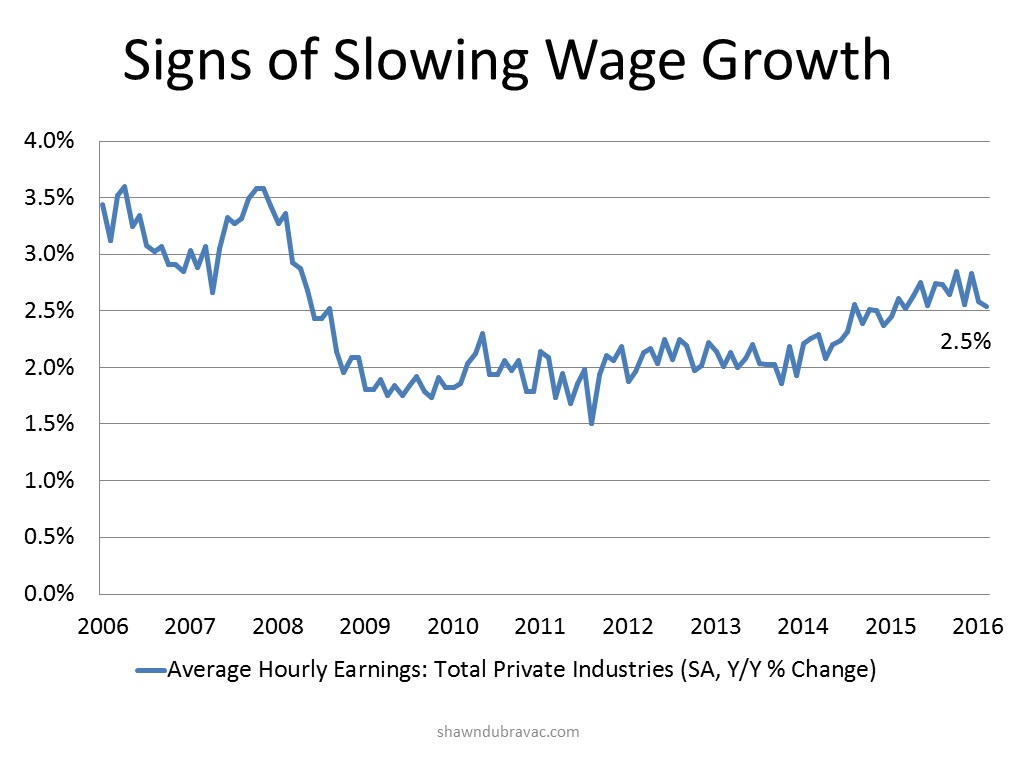

But beyond the headlines, the April report was weak around the edges. Much of the job growth materialized in low-wage sectors, cyclical areas like manufacturing and construction added few jobs, and growth in hourly earnings is slowing, at least temporarily.

Slowing wage growth in the face of extremely low unemployment is perplexing, if not concerning. There are a few possible reasons wage growth hasn’t been more robust even in the face of declining unemployment.

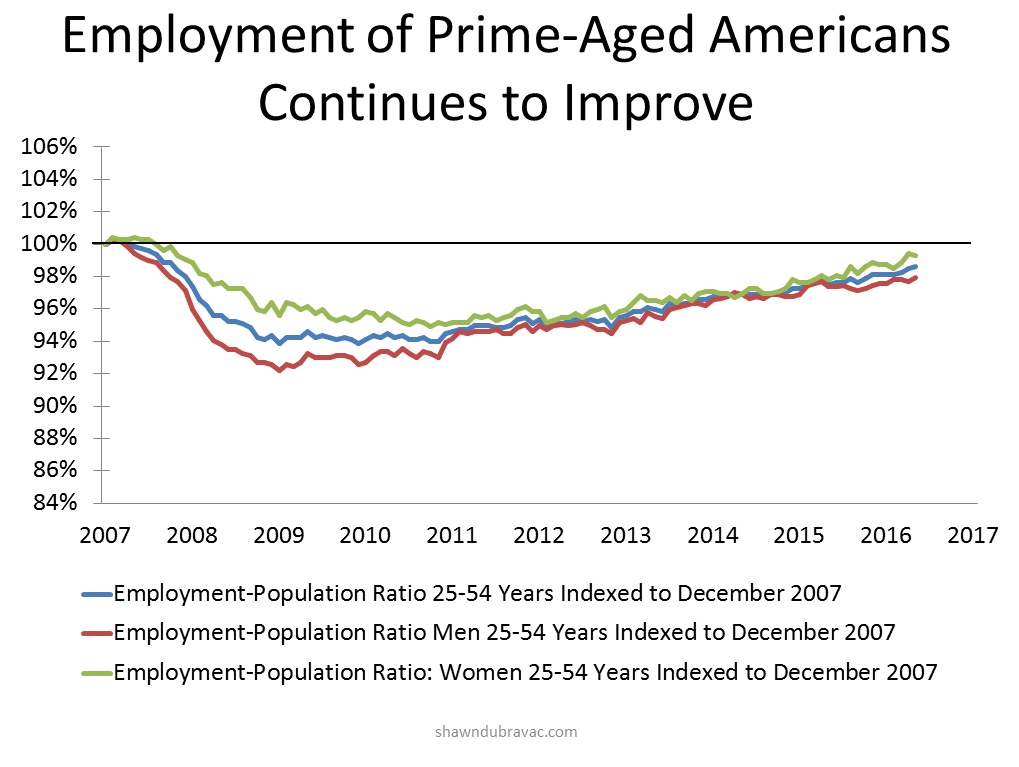

First, there might still be slack in the labor market. And more precisely, there might be slack in specific segments of the labor market. Broader measures of unemployment remain above pre-recession levels despite significant improvements through the economic recovery. The U-6 measure of unemployment includes not only those who are seeking work and can’t find it but also includes workers who are marginally attached or those who are working part-time for economic reasons and would prefer to be working full-time.

As of the April jobs report, 78.6 percent of prime-aged Americans are working – an improvement from the recession fallout but not quite back to pre-recession levels. This metric might also suggest slack remains in the labor market. The employment-to-population ratio of prime-aged women has almost returned to pre-recession levels. As the charts below illustrates, the employment-to-population ratio of prime-aged men fell most significantly during the recession and while it has recovered significantly, it still remains about two percent below it’s pre-recession level.

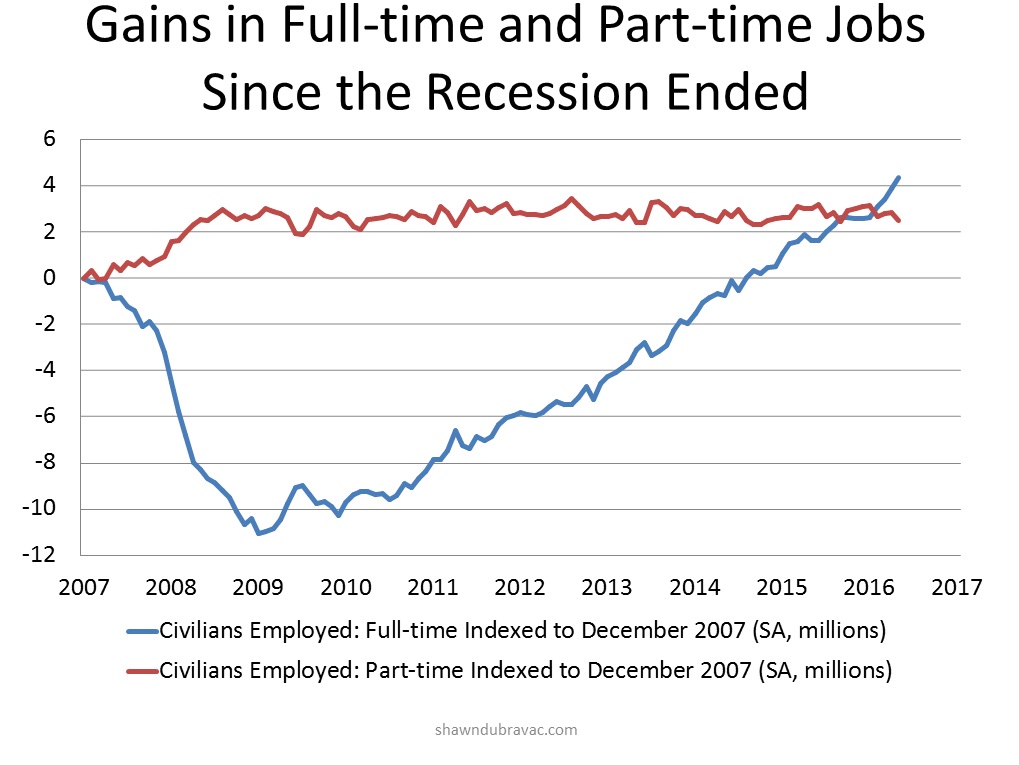

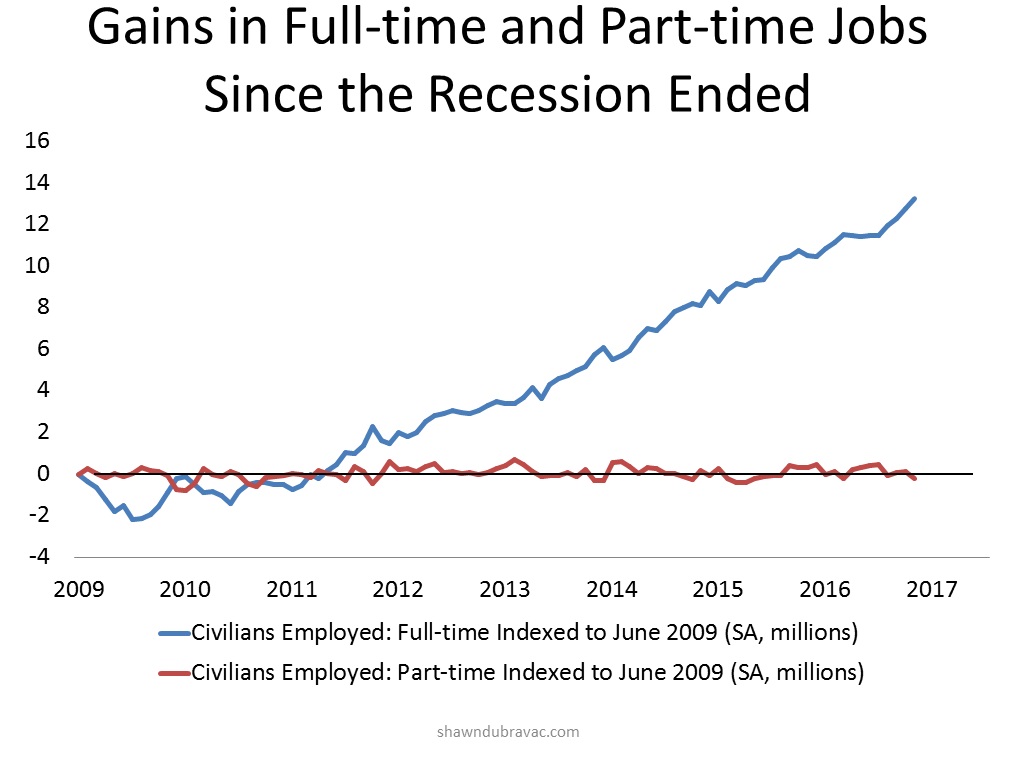

The split between part-time and full-time jobs depends to some degree on how you look at the statistics. We’ve added 2.5 million part-time jobs since December 2007. That’s over ten percent of total part-time employment, but essentially all of that growth came during the recession. We’ve added 4.4 million net full-time jobs since December 2007, or roughly three percent of total full-time jobs. But as the chart below illustrates, we lost about 9 million jobs during the recession and we’ve gained over 13 million jobs since the recession ended. Most of the jobs we’ve added since the end of the recession are full-time jobs. The number of part-time jobs has changed little since the end of the recession. However the number of full-time jobs in the labor market is about five times larger than the number of part-time jobs. We’ve added about 6.9 jobs since December 2007, but over a third of them are part-time jobs. This mix could be one reason for slow wage growth and slow labor productivity gains.

A second reason for slow wage growth is muted labor productivity. As workers become more productive they equally become more valuable to potential employers and can therefore demand higher wages. Lackluster productivity growth is likely stymieing wage growth.

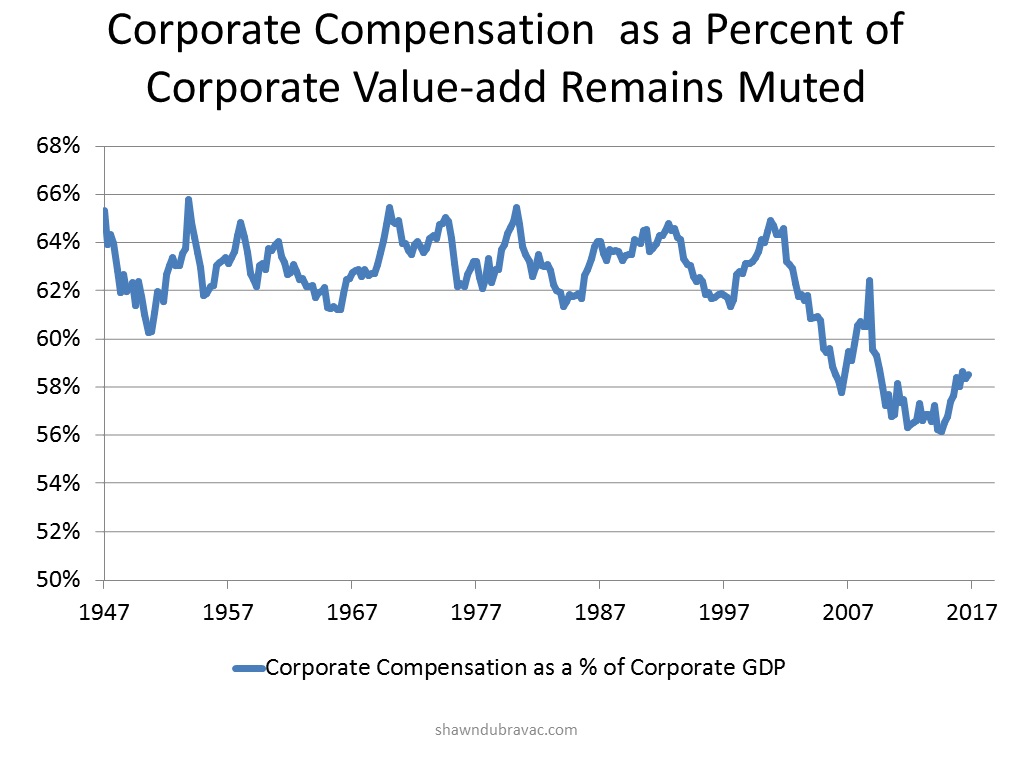

Finally, a third reason for slow wage growth could be that corporations just aren’t paying out as much of their corporate gains to employees as they have in the past. Corporations are paying out a historically low share of their value-add. For much of the post-war period, corporate compensation as a share of corporate GDP hovered around 63 percent. It began to decline in the early aughts and has yet to fully recover. In recent months it has improved slightly, however corporate compensation as a share of corporate value-add remains muted. As a result employees are garnering a smaller share of corporate value-add.

Digitization and automation might also be at play in some of what we are seeing materialize in the labor market. Research by David Autor suggests high-skill, high-wage employment growth decelerated in the 2000s. The historical U-shaped growth profile exhibited in prior periods gave way to a downward sloping curve. Autor also found that occupations losing employment share increasingly come from higher ranks of the skill distribution. For example, the highest ranked occupation to lose employment share during the 1980s was at the 45th percentile but moved to the 75th percentile in subsequent time periods. This phenomenon suggests displaced middle-skill employment is moving into higher-skilled areas. If workers who were historically in higher-skill, higher-wage jobs weren’t able to gain employment because large components of their job were digitized and automated then they would fall to the low-skill, low-wage jobs. Increased competition in low-skill, low-wage jobs would keep wage growth down. However, if this were the case, then increases in digitization and automation would be accompanied with higher grow rates in capital expenditures as well as labor productivity – both of which remain relatively muted.