At their I/O conference this week, Google announced the release of their forthcoming Asus Nexus 7 Tablet which is available for pre-sale now and will ship mid-July. The forthcoming release has been well covered today so I’ll just highlight a few interesting points and discuss the potential motivation for launching a tablet device. According to Google’s Android head Andy Rubin, the $199 price is essentially the OEM wholesale price, suggesting Google is making no money on selling the device and in all reality losing money in aggregate when marketing and promotion of the device is taken into account.

The origins of the Asus Nexus 7 Tablet started with CES.

From start to finish, the product took about four months – an incredibly short cycle and certainly a sign of what will increasingly be expected of device designers and manufacturers.

Here’s a quick chart of the specs from PC World. I’d note that it is Wi-Fi only, lacks a rear camera, is powered by the quad-core tegra 3, and has 1280 x 800 screen resolution.

From the very beginning I’ve noted research showing tablets are primarily used for lean-back, consumption-oriented activities. While tablets are mobile by definition they are portable in practicality. There is a difference between portability and pocketability. Consumers are primarily using tablets within the home and at other static locations (coffee shops, office workspace, etc). They are primarily utilizing Wi-Fi to connect to the web as opposed to relying on cellular service.

Google has taken all of this to heart in positioning the Asus Nexus 7 Tablet. The Nexus has a powerful processor, a high resolution screen, and a very strong go-to-market price. The device is squarely positioned as a low-priced, high consumption-oriented device. Perhaps the only trade-off they are making in bring the initial product to market was choosing a 7 inch screen instead of a larger screen. Consumption and available real estate appear to be correlated. As comScore points out, consumers using tablets with 10 increase screens are consuming about 40 percent more content than consumers using 7 inch tablets. I imagine this trade-off was ultimately driven by the desire to keep the opening price point below $200 and I further imagine we’ll eventually see a 10 inch one if the device can gain traction in the marketplace.

Google still faces headwinds in gaining traction within the tablet marketplace. While Android has grown it’s footprint in the smartphone space extremely well and by some estimates now controls over 50 percent of all smartphone, the same is not true in the tablet segment. Here’s the view of several wall street analysts on the Asus Nexus 7 announcement. I think Credit Suisse’s Kulbinder Garcha captures much of the impetus for Google’s announcement. As he wrote, “So far there has been limited sustainable traction for Android in terms of tablet share.” Google’s own data reveals this same conclusion.

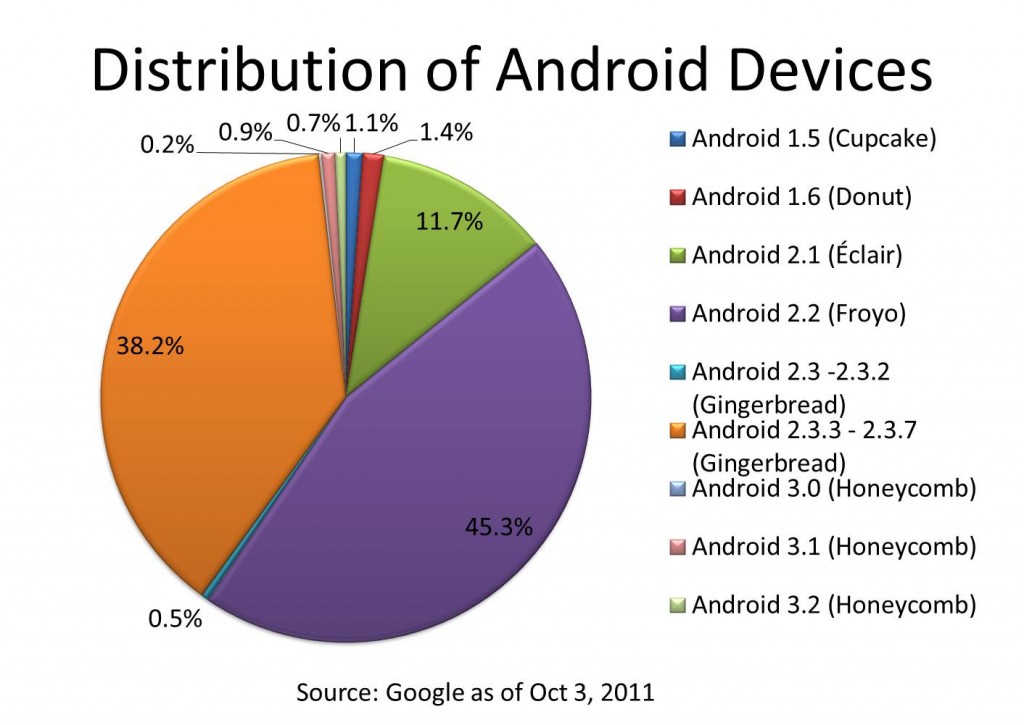

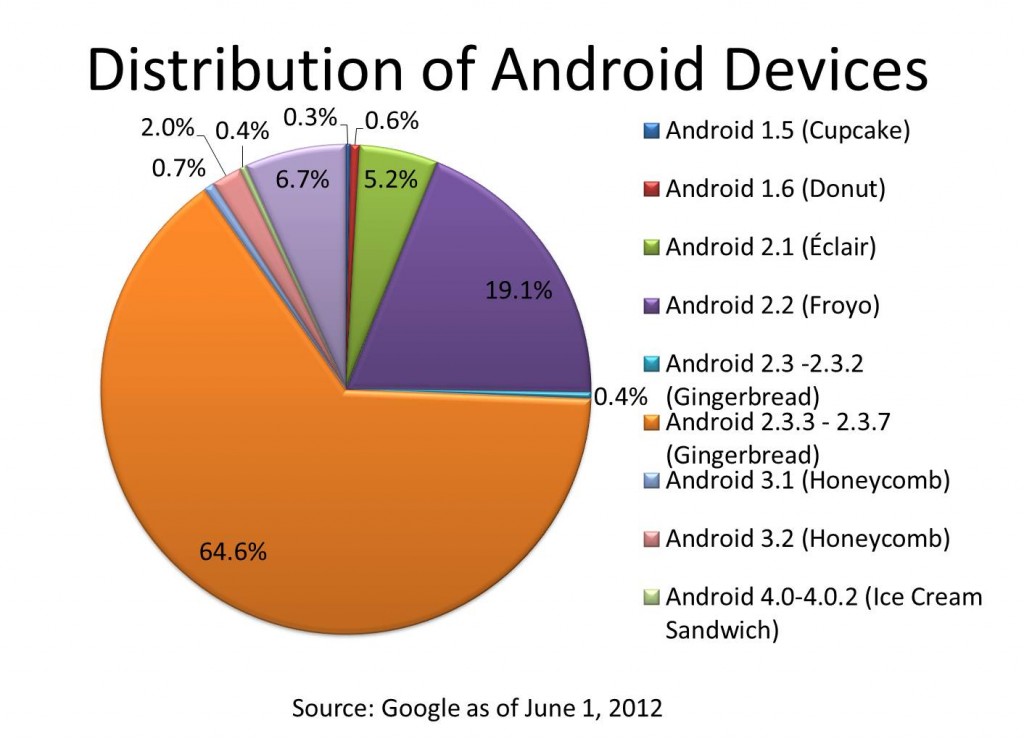

The two charts below show the percentage of Android devices that have accessed Google Play (formerly Google Marketplace) within a 14-day period ending on the collection date noted below each chart. In October of 2011, only two percent of the android devices accessing Google Play were devices running android 3.1 or higher. Android Honeycomb was the first android version optimized for larger screen tablet devices. By June of this, the share has increased significantly but is still only 10 percent of all Android devices accessing Google Play. Related date is sourced from Google here.

To-date, Android has had limited success in cracking the tablet market and this move surely is an attempt to become more influential in the tablet market. A mid-July launch also does at least three things. First, it takes advantage of the summer travel/vacation season. Tablets are well positioned for the vacation season. Second, it gets it into the market and allows the device to be both sufficiently inventoried as well as buzzed about heading in the back-to-school season. Third, it gets in front of September product launches which are increasingly building with Apple, Amazon, and others focusing their product and model launches on that time of the year. As an aside, I think one of the reasons we are seeing more September products launches is that supply chains have improved. Companies can now bring -to-market products in September and still have them sufficiently placed at retail, stocked, and buzzed about in time for the November and December buying season.