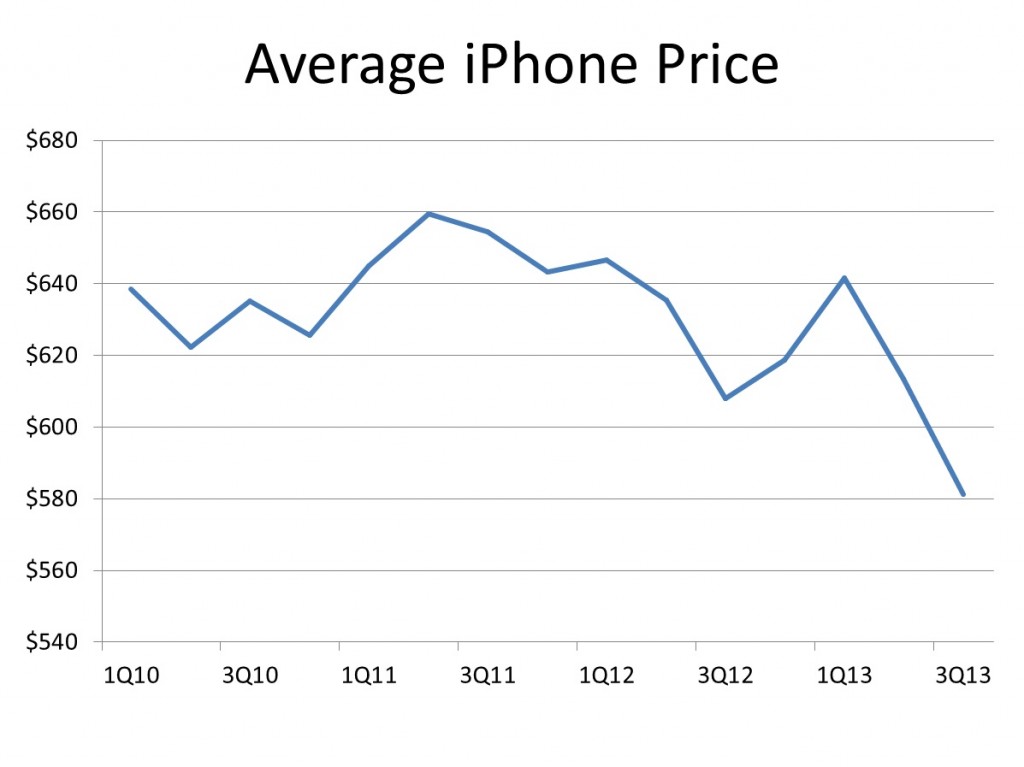

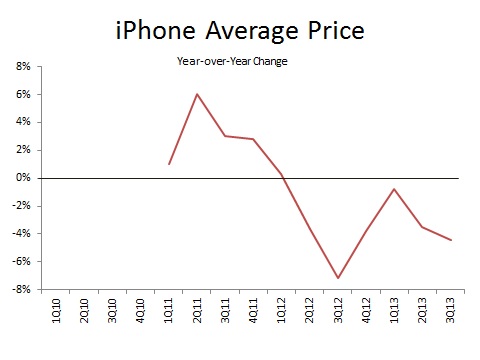

The new iPhones went on sale today. Since the announcement, much as been written about the two models – and especially the implications for Apple. I previously reviewed some of the insights gleaned from Apple’s financial statements and wanted to enumerate on that discussion. As the following charts illustrate, Apple’s reported price for the iPhone has declined slightly over the last 18 months. The average price in 3Q13 was a reported $581 – roughly 10 percent below the $646.53 reported in 1Q12.

This price decline could tell us a number of things. Naturally, on the surface it tells us buyers are moving to lower priced iPhone models. They could be buying older models or simply iPhone models with less storage. This could tell us interest in the product class is waning and while individuals aren’t abandoning the product they are feeling satisfied with “good enough” and willing to buy either an older model or one with less storage. Both of these options are also consistent with a maturing market. As a product matures late adopters tend to buy less feature-rich options.

Apple’s fiscal 4Q13 (and subsequently fiscal 2013) ends on September 28, 2013. As a result about eight days of sales of the new iPhones will end in 4Q13 while any after that will land in 1Q14 and fiscal year 2014. I expect sales to be brisk through those first eight days, but because it is only eight days I don’t expect it to have a material impact on the average iPhone price as reported by Apple at quarter end. Perhaps the average iPhone price in 4Q13 will be in the $572 range – lower than 3Q13 but not significantly lower. I do however expect to see the price materially lower in 1Q14 – dropping to something in the $540 range – or about 16 percent below the year-ago price of $640.

This isn’t meant to be a pricing forecast exercise but rather a narrative around the evolution of technology adoption. As much as we might want to ignore it, supply is upward sloping and demand is downward sloping. By introducing a lower priced option – even if it isn’t as low as the financial markets think it needs to be – supply shifts in. Even with no change in demand, a higher quantity of demand is, well, demanded. So if the average reported price does come down as I expect, then unit volume will move up – perhaps significantly. iPhone demand is price elasticity so consumers will respond to prices – as we’ve seen with tablets.