I wrote early this month about the features of connected wristwatches. Since this time there has been significant digital ink spilled discussing the connected wristwatch space with a focus on Apple’s potential foray into the market (see: 100 people are working on the Apple watch, Apple’s entry into wearable tech, On the Apple Watch watch, Apple watch that talks to your iPhone appears in patent, and a thousand more articles).

There is always some trepidation in throwing a number out for the potential addressable market for very nascent – and in this case nearly nonexistent – categories. A back-of-the-envelope forecast for connected wristwatches will surely haunt me and in these exercises I always think of the cellular telephony forecast McKinsey constructed in 1980 at the request of AT&T (whose Bell Labs had invented cellular telephony). McKinsey & Company predicted 900,000 subscribers by 2000 – only slightly less than the 109 million that actually existed by that year.

But with that caveat squarely attached, I want to walk through some of my thinking on this topic.

Background Assumptions

Today there are roughly 240 million adults in the U.S. living across about 119 million households (There are about 314 million total living in the U.S., but for this estimate – and simplicity – we’ll focus on the adult population). Roughly 87 percent of American adults have a cell phone and about 45 percent of American adults have a smartphone.

With these type of exercises, it is always important to remember two things: (1) rarely does a product see 100 percent adoption (and only a few tech devices have ever even seen household adoption above 85 or 90 percent), and (2) adoption follows logistic functions. This second point means slow adoption in the early years followed by several years of accelerating adoption before eventually the second derivative of the growth function turns negative (adoption grow continues but at a slower pace). While not always evident, the first derivative of the growth function often turns negative in the end (adoption/ownership actually declines as consumers move to new products and forego replacement).

I prefer the term connected wristwatch over “smart” watch because we are really talking about watches that primarily connect to the Internet by piggybacking on the connection of the smartphone or some other Internet-enabled device. Because most connected watches will leverage the embedded connectivity and functionality of smartphones the addressable market today is probably the 45 percent or so of U.S. adults that have smartphones. Over the long-run many and perhaps most mobile phone users will likely adopt smartphones so the longer-run addressable market is probably closer to 80 percent or 85 percent of U.S. adults. This suggests a current addressable market of roughly 108 million individuals and a potential long-term addressable market of say 190-200 million adults.

Anything that attaches to mobile phones is by definition one of the largest addressable markets in tech because of the high ownership rate of the underlying device. This is one of the largest reasons connected watches deserve the attention they are getting. But obviously not all smartphone users will adopt connected watches. The global watch market is itself a not small addressable market, with some estimates suggesting a $45 billion global market. I’d guess 25 percent to 40 percent of this market is in the U.S. The wristwatch market today is not surprisingly driven heavily by luxury brands and high-end watches. The watch market has become more of a fashion accessory than the utility device it once was because individuals are using their mobile phones as their timepiece in most cases. But these dynamics could reverse as the connected watch becomes more than just a timepiece device.

Without doing any real research, if I had to guess I imagine long-term attachment rates of perhaps 30 to 40 percent seem reasonable if the category is successfully established so you are looking at an installed base of maybe 60 million to 80 million owners in the U.S. If the category never materializes of course then you are looking at maybe one to two percent adoption over the life of the category.

The average smartphone is replaced roughly every 18 months in the U.S. and U.S. carrier subsidy models accelerate the replacement cycle compared to other markets. While smart watches are less expensive than smartphones they aren’t likely well suited for subsidy programs since they leverage the connectivity of the mobile phone. But they would be influenced by fashion which might shorten the replacement cycle. Guessing, I imagine connected watches would be replaced every 36-48 months.

Summarizing, here are my (early) basic assumptions:

- Long-term (underlying) addressable market= roughly 200 million smartphone users

- Attachment rates to that addressable market = 30 percent to 40 percent or 60 million to 80 million

- Replacement cycle = 3-4 years

- Density rates = 1. I assume adopting consumers own about one on average.

- Replacement rate. In this exercise I’m primarily focused on initial adoption, but could also factor in replacement cycles. My starting estimate is that 80 percent of users actually replace the product. This 80 percent figure would fluctuate higher or lower depending on how committed users are to the device and I imagine it naturally decays over time. An 80 percent replacement figure suggests a pretty strong commitment to the device and an otherwise successful category.

With these starting assumptions, I’m suggesting the category is generally successful with the portion of the addressable market that adopts the technology relatively committed to the category. Whether the category can bring value to the consumer and realize this potential (or even surpass it) remains to be seen.

Sizing the Market for Connected Watches

We are already getting a sense for early demand for connected watches.

Kickstarter darling Pebble reports they’ve sold about 85,000 watches to-date. Here I use some relatively simple diffusion equations to approximate what sales would look like over the next 30 years given the assumptions above. A few things to note in the following charts.

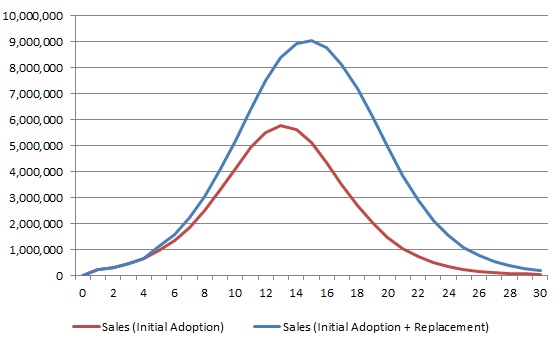

First, total U.S. sales hit about 220,000 this year and 320,000 next year. Annual sales break the million market for the first time in year 6 and subsequently annual sales peak in year 13 at about 5.8 million. Over the 30 year period, 60 million devices are sold and if you consider replacement cycles another 47.7 million devices are sold just by replacing 80 percent of the first cycle of purchases. This latter figure grows if you consider multiple replacements over this forecast horizon.

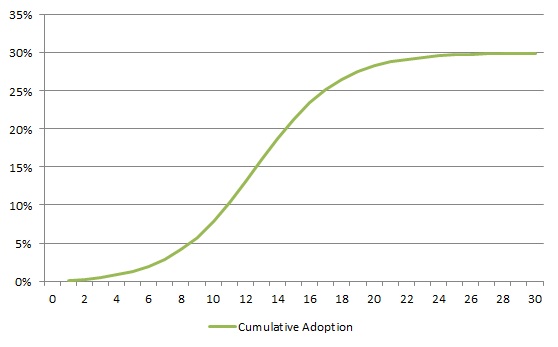

Given the simplified model I’ve used, five percent of U.S. adults own the product within 9 years and 10 percent own it with 11 years. By year 24 adoption rates have reached 30 percent at which point I’ve assumed they reach their steady state. If I were to project broader adoption then ownership rates would accelerate over the forecast horizon. In other words, we’d see a higher rate of ownership rates more quickly.

I actually believe adoption rates are broadly accelerating. I’ve written about this in the past. Information diffusion is happening more rapidly today. Potential buyers are learning more quickly about new technologies. Adoption rates are still following logistic functions but those logistic functions are being compressed over a shorter time period. New products are finding life (or conversely death) much more quickly today.

I actually believe adoption rates are broadly accelerating. I’ve written about this in the past. Information diffusion is happening more rapidly today. Potential buyers are learning more quickly about new technologies. Adoption rates are still following logistic functions but those logistic functions are being compressed over a shorter time period. New products are finding life (or conversely death) much more quickly today.

The above approach is a simplistic model that suggests what adoption might look like given some average parameters and assumptions. Clearly, reality will look much different. The first few hundred thousand units of any device are relatively easy to sell. I like to say there is a 50,000 unit market for everything. It is the next few hundred thousand that are more difficult to sell.

Does the Entry of Apple Change these Estimates?

Maybe. By some estimates, Apple controls about half of the U.S. smartphone market so about 54 million U.S. adults have Apple iPhones. Presuming maybe five percent to ten percent of the installed base are early adopters of Apple products and buy within the first 12 to 18 months, so you are looking at maybe two to five million iWatches selling over the first 12 to 18 months. That figure is four to ten times what I estimated above. But I think an Apple entry influence is more of brand story than a product viability story. Long-run adoption dynamics and replacement cycles will be less influenced. I think Apple’s entry could shift the market and compress the adoption cycle as I discussed above, but I don’t know that it changes the market size for the category over a longer horizon.

What Do Connected Watches Do for a Company’s Bottom line? (ie Why Enter the Connected Watch Market?)

At the end of the day, companies like Apple are hardware companies. As public companies they have investor communities they must appease. They do this by growing both top-line and bottom-line revenue. They need to grow both sales (top-line revenue) and net income (bottom-line revenue). They do this by entering into new markets and selling more stuff. At the same time, they must maintain (or increase) margin which ensures net income grows inline with top-line revenue growth. Companies want to grow sales but not if it sacrifices profitability (obviously). Companies must think carefully about the type of new markets they enter.

Service markets are generally attractive new markets because they typically have relatively high margin. This is one of the reasons you see companies from telcos to cable companies to utility companies to hardware companies entering into new service and entertainment markets. It is also the reason you see companies like Cisco exit certain markets. Cisco recently announced they were selling off their Linksys business and they completely shuttered what was believed to be a successful Flip division simply because these divisions had lower margins than they were accustomed to within their core business units.

For well over a year there have been rumors Apple would enter into the TV business. This would certainly help grow top-line revenue, but the impact on company margin is less clear. On the other hand, connected watches are a category that are relatively margin rich so they represent a pretty attractive new market for a company looking to maintain margin while growing sales.