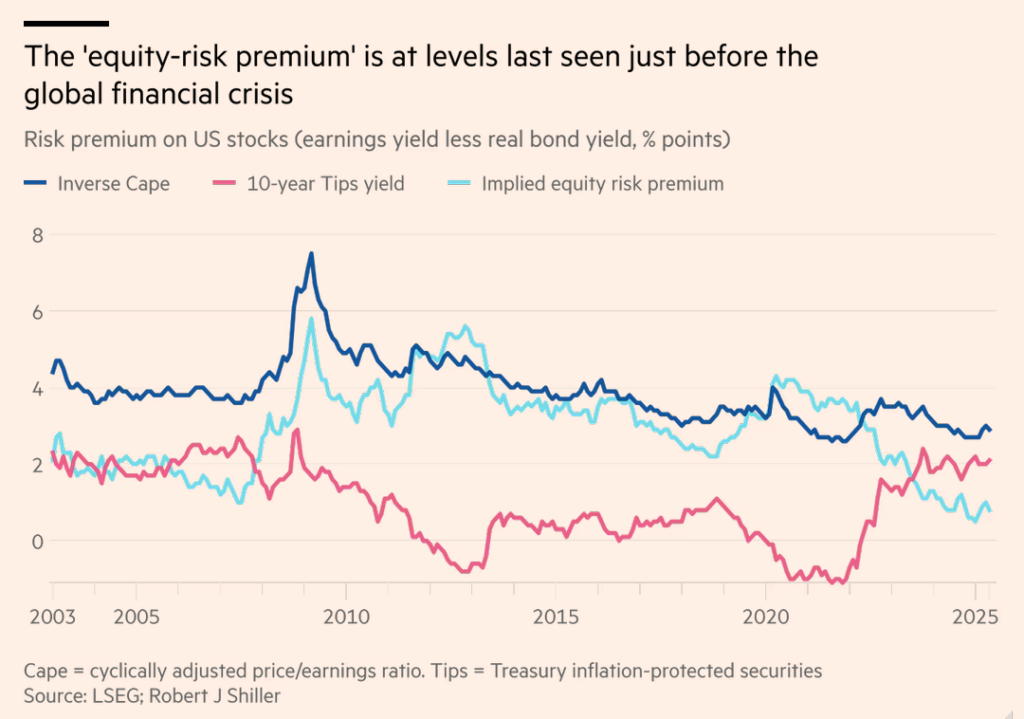

The equity risk premium is back to 2007 levels. What are the markets missing?

Martin Wolf flagged something in the Financial Times that I’ve been quietly concerned about.

The spread between the real bond yield and the cyclically adjusted earnings yield is now as low as it was in June 2007.

Yes, that June 2007.

Back then, markets were priced for perfection, until they weren’t.

Today, the story rhymes: equities are priced for high growth. But the gap between interest rates and earnings yields, which is the extra reward you get for holding riskier stocks instead of safe bonds, is almost gone.

Let’s unpack this:

In 2007, low equity risk premium reflected a world convinced of smooth, uninterrupted growth.. Then came the global financial crisis.

Today, the equity risk premium is low again, despite two wars, sticky inflation, geopolitical fragmentation, and a fragile global economy.

-> Low ERP doesn’t just reflect optimism. It likely signals mispricing of risk.

-> It suggests complacency that is likely amplified by passive investing.

-> It raises the odds of a sharp correction if earnings miss or rates climb or any number of negative surprises challenge the current outlook.

Valuations are not destiny, but they do warn us when the future is priced as if nothing can go wrong. Right now, the signal is flashing red to me.