Recently I’ve been asked repeatedly about the current state of Europe. I’ve said since January that 2012 was going to be marked by periods of volatility – stressing that European issues would be a key catalyst to those periods of volatility (energy prices have also contributed to uneasiness – something I’ll say more on at another time). I was recently quoted in a Bloomberg article and a point I made deserves repeating – a lack of confidence can be very contagious.

Following the recession of 2007-2008, economic agents remain skittish. Individuals, small and medium-size enterprises (SMEs), and even large enterprises remain apprehensive and risk averse. Investors are opting to sit out uncertainty and the ensuing volatility.

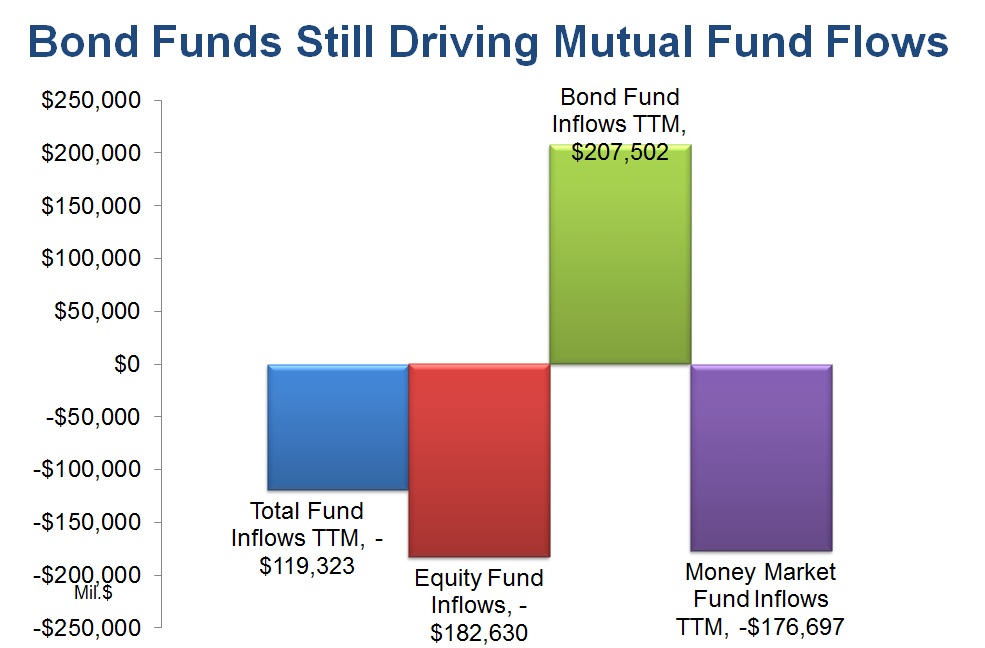

As the chart depicts, over the last 12 months bond mutual funds have experienced inflows of over $200 million dollars while equity mutual funds, money market mutual funds, and total mutual funds have all had negative inflows in the last 12 months.

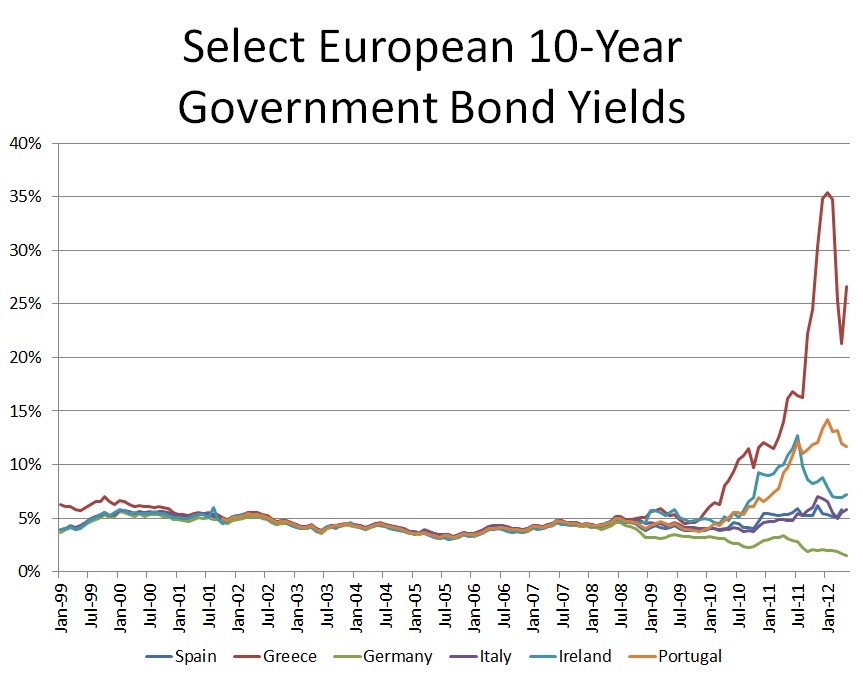

European government bond yields have blown out as investors have lost appetite to hold the debt of at-risk countries.

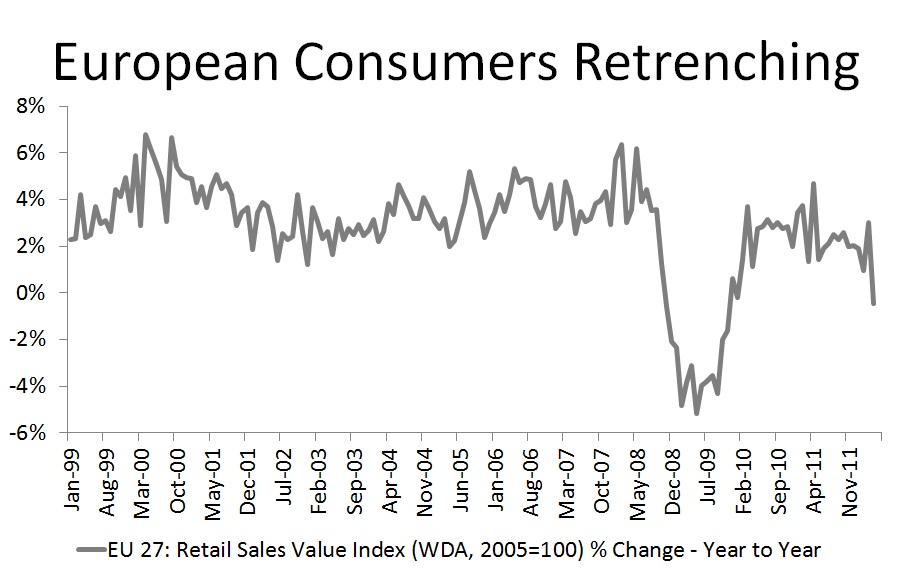

European retail sales indices have moved into negative territory as the continent continues to be battered with negative news.

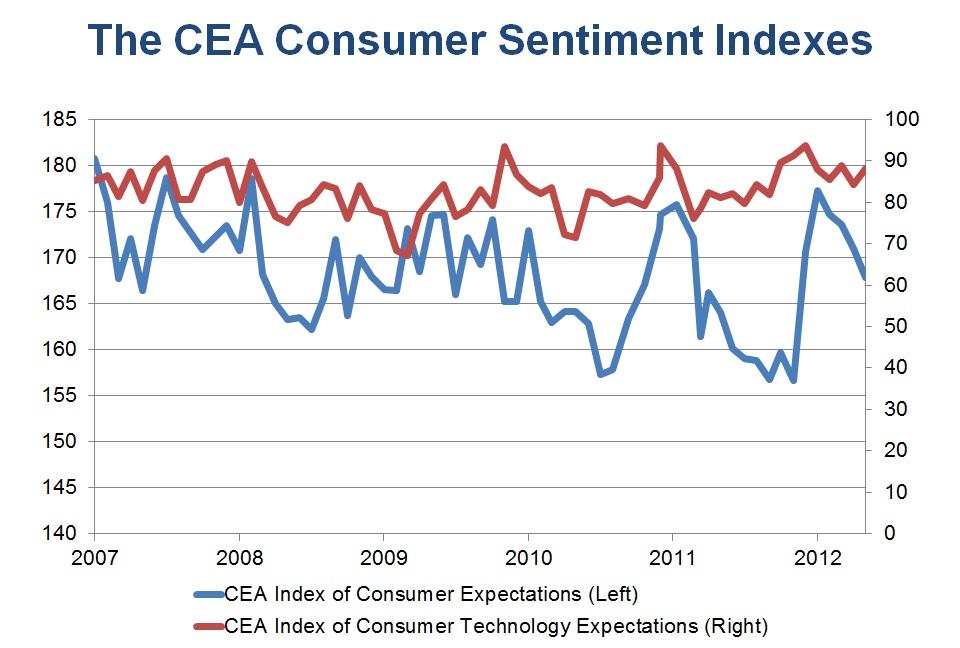

Here in the US, consumer confidence is eroding as measured by CEA’s Consumer Confidence Indexes and other measures of consumer sentiment.

The contagion of confidence can be seen elsewhere as well. For example, manufacturers, distributors, and retailers are all keeping inventories well maintained. The strain of the 2007-2008 recession is still fresh. When there are shocks to certainty, economic agents – be it individuals or business – revert very quickly to those fresh memories. They retrench and that is seen in the sampling of charts above.

The European crisis of confidence is going to continue through the June 17th vote in Greece and will linger through the remainder of the year. Crisis will continue to flair up in pockets of uncertainty. The US will face it’s own crisis of confidence in October as elected officials wait until the last hour to address the fiscal cliff (CBO analysis here, Bernanke’s testimony from yesterday here). Because I don’t think they solve the problem in its entirety but simply kick the can down the road there it will result in a lingering lack of confidence here as well.

Globally, emerging markets from Brazil to India to China are all slowing – adding to the lack of certainty. A lack of confidence can be very contagious and right now that lack of confidence is spreading broadly.