AI agents are entering the mainstream. At their core, these are assistants that can think, act, and execute tasks across multiple apps on your behalf. Their unique advantage is that they combine automation with reasoning, meaning they don’t just follow scripts, they make decisions based on context. That means they can pull data, draft messages, schedule meetings, or update records without manual input.

Why AI Agents Matter for Financial Advisors

For financial advisors, AI agents can handle routine but time-consuming work such as onboarding clients, organizing meeting notes, monitoring portfolio changes, or preparing compliance reports. Used effectively, they free advisors to focus on higher-value activities like strategy, relationships, and personalized guidance.

In the months and years ahead, it’s easy to imagine a world where financial advisors employ hundreds of AI agents, each handling a different part of the workflow.

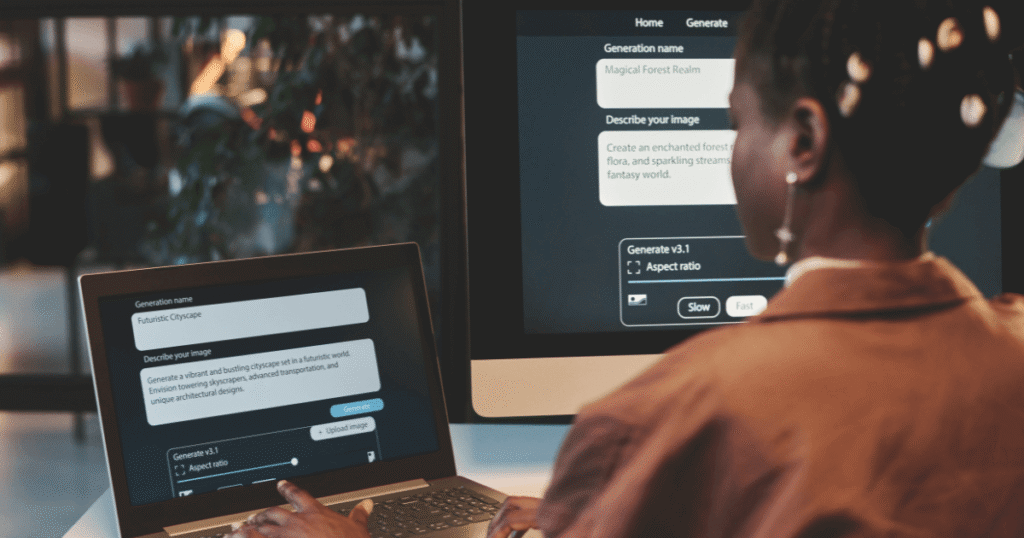

The Rise of AI Agent Builders

AI agent builders like n8n, Zapier, and Make represent a new generation of automation platforms. Historically, these tools handled simple, rule-based actions such as sending an email when a form was submitted. Today, they can chain together multiple steps, apply reasoning, and even use AI models to make decisions.

Think of them as orchestration layers that let financial advisors build their own digital coworkers without needing to write code.

Speed, Flexibility, and Scale

The biggest benefit is speed and flexibility. Advisors can now connect their CRM, email, scheduling, and compliance tools so repetitive tasks such as logging client interactions or generating summaries happen automatically.

Zapier’s Canvas feature lets users visually map out these processes, while n8n allows firms to self-host the software for tighter data control. These tools lower the barrier to automation and make it possible for small advisory teams to scale like large firms.

Balancing Automation and Compliance

Of course, automation in financial services comes with tradeoffs. Advisors operate in a highly regulated environment, where every AI-generated message or meeting note can qualify as a record that must be archived. If you’re not careful, an automation designed to save time could inadvertently create supervision gaps or recordkeeping violations.

That’s why features like Make’s detailed activity logs or n8n’s open-source auditability matter so much, because they provide visibility into what the AI agent did, when, and why.

Practical Use Cases

Here are a few ways advisors are beginning to use AI agents today:

- Automating client onboarding flows and document collection

- Creating alerts when portfolios drift from targets

- Drafting personalized follow-up emails after meetings

- Generating pre-meeting summaries and prep materials

- Monitoring regulatory updates and compliance thresholds

The most effective implementations start with process design first and AI second. Clarify the workflow, then use AI to assist with reasoning, writing, or classification along the way.

Empowering Advisors to Build Their Own Tools

Perhaps the most exciting development is what this shift means for innovation. These platforms give financial advisors the freedom to build exactly the tools they need, even if those tools only serve a small niche.

A financial advisor can now automate workflows or create specialized client experiences that wouldn’t be profitable for a developer to build at scale, but are incredibly valuable within their own practice.

In short, AI agents are not just changing how advisors work, they’re changing what’s possible to build in the first place.

Related content you might also like:

- From Assistant to Colleague: The Rise of Autonomous AI Agents

- 5 Rules for AI-First Shopping

- Morgan Stanley is taking its AI @ Morgan Stanley Assistant fully live for all financial advisors

- How Leaders Are Using AI to Make Smarter, Faster Decisions

- Walmart AI Strategy 2025: Operational Lessons