The summer starts and ends with a holiday. With the latter holiday now behind us I thought I’d take a moment to provide an update on my views of the current state of the financial markets.

On August 7th – I moved an additional 5 percent of my portfolio into cash – and am still considering moving a further share into cash. Stocks through August 2nd were up about 17 percent for the year – but my assessment continued to be that things were unstable and finally warranted a reallocation. Since August 2nd the market has been down around 4.49 percent. August was the worst month since May 2012 when the market was down 6.27 percent. It is only the third monthly decline in the last 15 months. I don’t think it will be the last down month for the year. I expect September and October could also be down months for stocks.

Even with August’s poor performance, stocks remain up 14.5 percent in 2013 – with the total return being 16.15 percent. The total return for stocks last year was 16 percent and I still question the markets ability to best that return when we finally close the book on 2013. I expect 2013 will be an up year – the question remains how up.

Underlying Fundamentals Lacking

The underlying fundamentals of the market remain unsatisfying. With 99 percent of issues reporting, 2Q13 earnings have set another record (both operating and as reported). While earnings estimates for 3Q13 have declined 2.1% since the end of June, they remain 2.6% above 2Q13 – consequently on track to set another record.

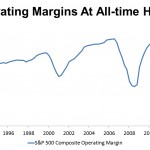

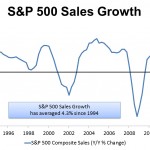

What I find unsettling is that the record earnings growth is coming not through sales growth but through near all-time high operating margins. Companies continue to report strong earnings because they remain extremely lean. Operating profit margins remain near all-time highs – something I don’t believe is sustainable over the longer-term. Over the long-run I want to see strong sales growth. As sales growth increases, companies will need to invest in order to capture those sales and as a result operating margin will – or should – decline.

Sales growth increased slightly in 2Q13. Annual growth increased to 2.9 percent from 2.5 percent in the first quarter. Both figures are well below the average annual sales growth of 4.3 percent. Operating margins remained near all-time highs and have thus supported record operating profits.

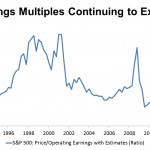

At the start of the year I had expected 4.3 percent sales growth for 2013. Average sales growth. I expected operating margins to recede to something closer to 8.7 percent. I expected multiples to expand in 2013 to 16 times earnings. Currently, sales growth is 2.9 percent with operating margins of 9 percent and earnings multiplies of 16.7 percent. These relationships were even more pronounced when August started. I think the market today is close to where it will close the year. I could also see further downside, with the market closing the year in the 1560 to 1590 range.

Cycle Update

We are 53.7 months into the current bull cycle – dating back to March 9, 2009. The average bear market lasts 56.5 months. If you exclude the 1990 to 2000 bull market – which ran 113 months – the average drops to something closer to 51 months. I think this bull market has the foundation to be longer than average but by the end of the year we will be beyond the average life cycle of most bull markets. Looking to 2014 should raise many questions for investors.

Uncertainties Gyrate

The future of Federal Reserve leadership remains uncertain. Fed tapering – timing and extend – remain uncertain. Watch the September 17th/18th Fed meeting for more on this – unless Friday’s employment report is horrible. Future Fed leadership remains uncertain. Consumer and corporate spending have remain tepid and questionable. Consumer spending is of key importance as we head into the ever-important holiday season. Egypt and Syria and who knows who’s next produce a tremendous amount of weight on the market. Mortgage rates have moved 150 basis points in only a few months. Housing is slowing. Issues impacting the economy are questionable.

I don’t expect these uncertainties to ease before year-end.