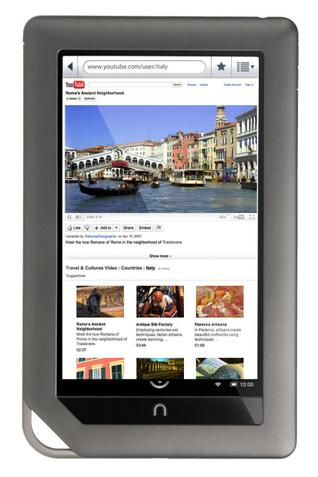

What happens when eReaders grow up to be tablets? This morphing is already well underway. Barnes & Noble has always referred to the Color Nook as a tablet eReader – with tablet being the operative word. At their event this week. B&N claimed the Color Nook is the top selling android tablet in the market. Amazon – the current king in e-ink eReaders – is getting set to launch potentially two new tablet-oriented devices. E-ink is actively working to bring to market color e-ink screens and other eReader players are treading towards tablet-like devices. But this evolution has important implications.

What happens when eReaders grow up to be tablets? This morphing is already well underway. Barnes & Noble has always referred to the Color Nook as a tablet eReader – with tablet being the operative word. At their event this week. B&N claimed the Color Nook is the top selling android tablet in the market. Amazon – the current king in e-ink eReaders – is getting set to launch potentially two new tablet-oriented devices. E-ink is actively working to bring to market color e-ink screens and other eReader players are treading towards tablet-like devices. But this evolution has important implications.

First, network economics for text are very different than they are for video and more data-intensive applications. One of Kindle’s opening hallmark features was the ability of the user to download books via the cellular connection without having to independently contract with the service provider. In fact, at one point Amazon switched Kindle cellular service from Sprint to ATT and users never took notice.

This won’t be the case as users gain access to more data-intensive offerings. These services are more bandwidth intensive (and therefore costly) than delivering text over the network. Even though our research has constantly shown most tablet users primarily connect via Wi-Fi, the existing service contracts can’t work when devices are more than books. This will be a key element in the new tablets being launched by Amazon.

App usage on apps-enabled devices will crowd out book usage. This has ramifications for device pricing. In the early days of Kindle, Amazon subsidized the content instead of the hardware. This changed as Apple moved into the book business and subsequently eReader OEMs began selling ebooks at the publisher price and subsidized the hardware prices (or atleast began selling them at very low margin). If the margin is made on the ebooks and their are less ebooks sold as a result of changing use-case scenarios – OEMs will be in search of a new business model to driven margin. I would argue that single purpose devices can (and will) exist in the marketplace. Consumers value single purpose devices. At the same time, consumers also value multifunction capabilities. Especially with new devices – where use case scenarios aren’t yet well defined – consumer value feature flexibility. This perceived conflict can and should co-exist. The perceived conflict ensures innovation and ultimately ensures consumers receive the features they want on the devices where they mean the most to consumers.

There are tremendous currents pushing companies toward multifunction devices. Consequently it takes significant corporate courage to continue with a single purpose device. Right now, there is remarkable pressure to make eReaders feature-rich, but I don’t think there is consumer appetite for featureful eReaders. Consumers view these as single purpose devices. The use-case scenarios for eReaders are well-defined. Consequently, users are less likely to be persuaded to buy a new eReader based on some hardware feature. Research from Google supports this thesis. The research found only 12% of eReader shoppers considered other devices. That compares to 20% for laptop shoppers, 29% for tablet shoppers, and 66% for netbook shoppers. Consumers understand what they want. Touch is perhaps the one caveat. Consumers have grown comfortable with touch and increasingly expect screens to be touch. The Nook announcement this week was no surprise. The next big hurdle for touch-oriented screens will be pen and handwriting input. This will be especially applicable for eReaders where users take notes and make

eReaders growing-up to be tablets is a natural component of the Innovator’s Dilemma. Momentum is always towards multifunction, user-case flexible devices. And that momentum is currently enveloping eReaders. But for many reasons, there will remain an strong and vibrant market for stand-alone, single purpose eReaders.